快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出67题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

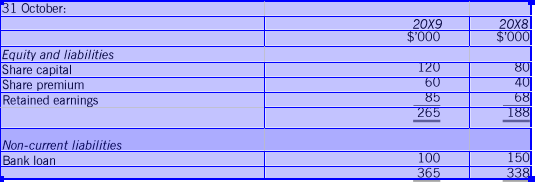

The following extract is from the financial statements of Pompeii, a limited liability company at

What is the cash flow from financing activities to be disclosed in the statement of cash flows for the year ended 31 October

20X9?

A draft statement of cash flows contains the following calculation of cash flows from operating activities:

$m

Profit before tax 13

Depreciation 2

Decrease in inventories (3)

Decrease in trade and other receivables 5

Decrease in trade payables 4

Net cash inflow from operating activities 21

Which of the following corrections need to be made to the calculation?

1 Depreciation should be deducted, not added.

2 Decrease in inventories should be added, not deducted.

3 Decrease in receivables should be deducted, not added.

4 Decrease in payables should be deducted, not added

The following extract is taken from a draft version of company’s statement of cash flows, prepared by a trainee accountant.

$000

Net cash flow from operating activities Profit before tax Depreciation charges 484

Profit on sale of property, plant and equipment 327

Increase in inventories 35

Decrease in trade and other receivables (74)

Increase in trade payables (41)

Cash generated from operations 29

760

Four possible mistakes that may have been made by the trainee accountant are listed below.

1 The profit on sale of property, plant and equipment should be subtracted, not added.

2 The increase in inventories should be added, not subtracted.

3 The decrease in trade and other receivables should be added, not subtracted.

4 The increase in trade payables should be subtracted, not added.

Which of the four mistakes did the trainee accountant make when preparing the draft statement?

Which, if any, of the following items could be included in ‘cash flows from financing activities’ in a statement of cash flows that complies with IAS 7 Statement of Cash Flows?

1 Interest received

2 Taxation paid

3 Proceeds from sale of property

Which one of the following statements is correct, with regard to the preparation of a statement of cash flows that complies with IAS 7 Statement of Cash Flows?

The following information is available about the plant, property and equipment of Lok Co, for the year to 31 December 20X3.

$!000

Carrying amount of assets at beginning of the year 462

Carrying amount of assets at end of the year 633

Increase in revaluation surplus during the year 50

Disposals during the year, at cost 110

Accumulated depreciation on the assets disposed of 65

Depreciation charge for the year 38

What will be included in cash flows from investing activities for the year, in a statement of cash flows that complies with IAS 7 Statement of Cash FlOWS?

A company sold warehouse premises at a loss during a financial period. How would this transaction be included in a statement of cash flows for the period that complies with IAS 7 Statement of Cash F/ows and that uses the indirect method to present

cash flows from operating activities?

Loss on disposal Proceeds from sa/e in cash flows from

Big Time Co had the following transactions during the year.

• Purchases from suppliers were $18,500, of which $2,550 was unpaid at the year end. Brought forward payables were

$1,000.

• Wages and salaries amounted to $9,500, of which $750 was unpaid at the year end. The financial statements for the

previous year showed an accrual for wages and salaries of $1,500.

• Interest of $2,100 on a long term loan was paid in the year.

• Sales revenue was $33,400, including $900 receivables at the year end. Brought forward receivables were $400.

• Interest on cash deposits at the bank amounted to $175.

Using the direct method, what is Big Time Co's cash flow from operating activities?

Which one of the following statements is correct?

Toots Co has made healthy profits for the past year, although at times the company has been close to running out of cash.

Because Toots Co is profitable, Adam, their accountant is unconcerned by the cash shortage. Jo, the financial controller at

Toots Co, is concerned. Jo tells Adam, ‘profits are fine on paper, but in the real world cash is king’. Jo believes Toots Co

needs to take a more proactive approach to cash flow management.

Adam and Jo have two different views. Who is correct, and why?