快速查题-ACCA英国注册会计师试题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

A company has used expected values to evaluate a one-off project. The expected value calculation assumed two possible profit outcomes which were assigned probabilities of 0.4 and 0.6.

Which of the following statements about this approach are correct?

(1) The expected value profit is the profit which has the highest probability of being achieved.

(2) The expected value gives no indication of the dispersion of the possible outcomes.

(3) Expected values are relatively insensitive to assumptions about probability.

(4) The expected value may not correspond to any of the actual possible outcomes.

Tree Co is considering employing a sales manager. Market research has shown that a good sales manager can increase profit by 30%, an average one by 20% and a poor one by 10%. Experience has shown that the company has attracted a good sales manager 35% of the time, an average one 45% of the time and a poor one 20% of the time. The company’s normal profits are $180,000 per annum and the sales manager’s salary would be $40,000 per annum.

Based on the expected value criterion, which of the following represents the correct advice which Tree Co should be given?

A company is considering the development and marketing of a new product. Development costs will be $2m. There is a 75% probability that the development effort will be successful, and a 25% probability that it will be unsuccessful. If development is successful and the product is marketed, it is estimated that:

Expected profit Probability

Product very successful $6.0m 0.4

Product moderately successful $1.8m 0.4

Product unsuccessful ($5.0m) 0.2

What is the expected value of the project?

Consider the following diagram.

If a decision-maker wished to maximise the value of the outcome, which options should be selected?

If a decision-maker wished to maximise the value of the outcome, which options should be selected?

How is expected value calculated?

If the decision-maker is trying to maximise the figure, what figure would the decision-maker choose at point B in the diagram below?

A company can choose from four mutually exclusive investment projects. The return on the project will depend on market conditions.

The table below details the returns for each possible outcome:

A B C D

Poor $400,000 $700,000 $450,000 $360,000

Average $470,000 $550,000 $500,000 $400,000

Good $600,000 $300,000 $800,000 $550,000

If the company applies the maximin rule it will invest in:

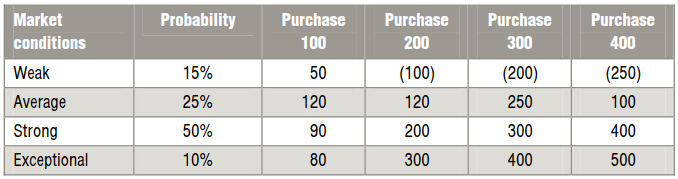

A supplier will supply company B in batches of 100 units, but daily demand is unpredictable. Company B has prepared a payoff table to reflect the expected profits if different quantities are purchased and in differing market demand conditions.

If the maximax criteria is applied, how many units would be purchased from the supplier?

If the maximax criteria is applied, how many units would be purchased from the supplier?

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking. Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses. There are three grades of truck, the A series, B series and the C series. The uncertainty faced is the expected growth in the on-line market it serves, which could grow at 15%, 30% or even 40% in the next period. Shuffles has correctly produced the following decision table and has calculated the average daily contribution gained from each combination of truck and growth assumption.

Which truck would the pessimistic buyer purchase? Enter only the letter:

Which truck would the pessimistic buyer purchase? Enter only the letter:

This objective test question contains a question type which will only appear in a computer-based exam, but this question provides valuable practice for all students whichever version of the exam they are taking. Shuffles is attempting to decide which size of fork-lift truck to buy to use in its warehouses. There are three grades of truck, the A series, B series and the C series. The uncertainty faced is the expected growth in the on-line market it serves, which could grow at 15%, 30% or even 40% in the next period. Shuffles has correctly produced the following decision table and has calculated the average daily contribution gained from each combination of truck and growth assumption.

Which truck would the optimistic buyer purchase? Enter only the letter:

Which truck would the optimistic buyer purchase? Enter only the letter: