快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出67题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

Which of the following material events after the reporting period and before the financial statements are approved by the

directors should be adjusted for in those financial statements?

1 A valuation of property providing evidence of impairment in value at the reporting period

2 Sale of inventory held at the end of the reporting period for less than cost

3 Discovery of fraud or error affecting the financial statements

4 The insolvency of a customer with a debt owing at the end of the reporting period which is still outstanding

The draft financial statements of a limited liability company are under consideration. The accounting treatment of the following material events after the reporting period needs to be determined.

1 The bankruptcy of a major customer, with a substantial debt outstanding at the end of the reporting period

2 A fire destroying some of the company's inventory (the company's going concern status is not affected)

3 An issue of shares to finance expansion

4 Sale for less than cost of some inventory held at the end of the reporting period

According to IAS 10 Events after the reporting period, which of the above events require an adjustment to the figures in the

draft financial statements?

In finalising the financial statements of a company for the year ended 30 June 20X4, which of the following material matters

should be adjusted for?

1 A customer who owed $180,000 at the end of the reporting period went bankrupt in July 20X4.

2 The sale in August 20X4 for $400,000 of some inventory items valued in the statement of financial position at $500,000.

3 A factory with a value of $3,000,000 was seriously damaged by a fire in July 20X4. The factory was back in production by

August 20X4 but its value was reduced to $2,000,000.

4 The company issued 1,000,000 ordinary shares in August 20X4.

IAS 10 Events after the reporting period regulates the extent to which events after the reporting period should be reflected in

financial statements.

Which one of the following lists of such events consists only of items that, according to IAS 10, should normally be classified

as non-adjusting?

材料全屏

64

【论述题】

Prepare a statement of cash flows for the year to 31 December 20X2 using the format laid out in IAS 7,together with the relevant notes to the statement.

材料全屏

65

【论述题】

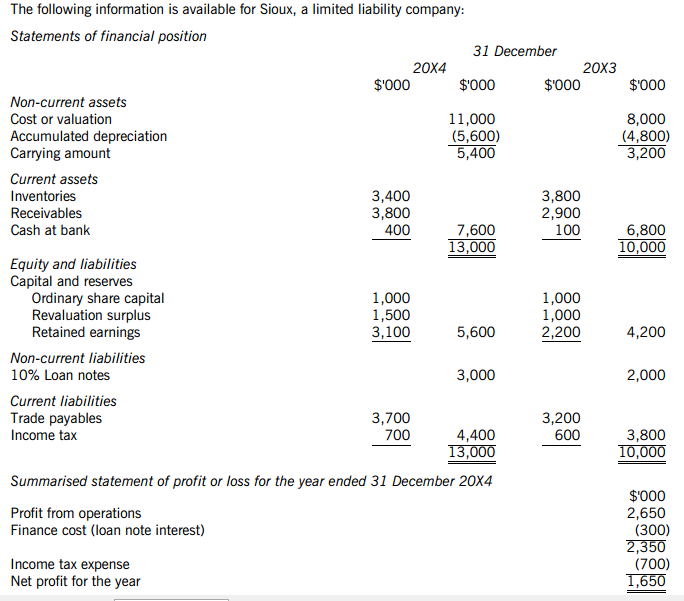

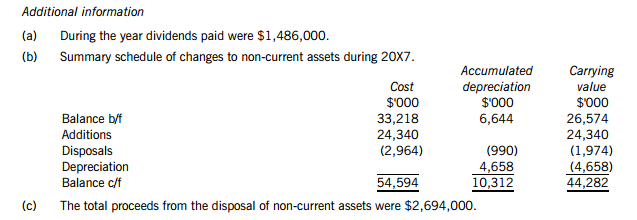

Prepare the company's statement of cash flows for the year ended 31 December 20X4, using the indirect method, adopting the format in IAS 7 Statement of cash flows.

材料全屏

66

【论述题】

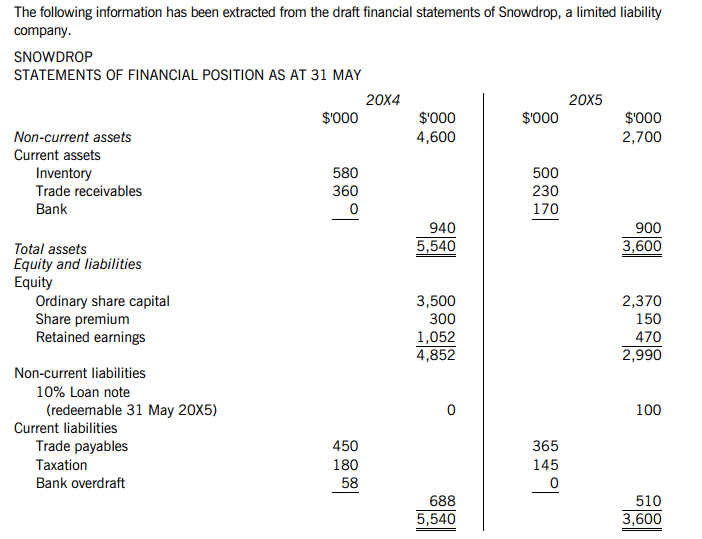

Prepare a statement of cash flows for Snowdrop for the year ended 31 May 20X5 in accordance with IAS 7 Statement of cash flows, using the indirect method.

材料全屏

67

【论述题】

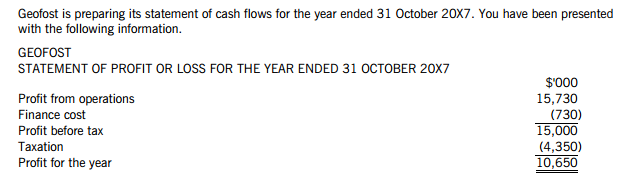

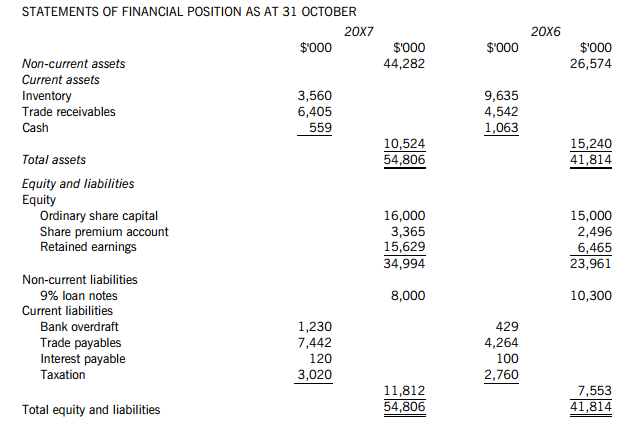

Prepare a statement of cash flows for Geofost for the year ended 31 October 20X7 in accordance with IAS 7 Statement of cash flows, using the indirect method.

Fanta Co acquired 100% of the ordinary share capital of Tizer Co on 1 October 20X7.

On 31 December 20X7 the share capital and retained earnings of Tizer Co were as follows:

$'000

Ordinary shares of $1 each 400

Retained earnings at 1 January 20X7 100

Retained profit for the year ended 31 December 20X7 80

580

The profits of Tizer Co have accrued evenly throughout 20X7. Goodwill arising on the acquisition of Tizer Co was $30,000.

What was the cost of the investment in Tizer Co?

Evergreen Co owns 35% of the ordinary shares of Deciduous. What is the correct accounting treatment of the revenues and

costs of Deciduous for reporting period in the consolidated statement of profit or loss of the Evergreen group?