快速查题-ACCA英国注册会计师试题

ACCA英国注册会计师

筛选结果

共找出70题

- 不限题型

- 不定项选择题

- 单选题

- 填空题

- 材料题

- 简答题

- 论述题

According to IAS 38 Intangible assets, which of the following statements about research anddevelopment expenditure are

correct?

1 Research expenditure, other than capital expenditure on research facilities, should be recognised as an expense as

incurred.

2 In deciding whether development expenditure qualifies to be recognised as an asset, it is necessary to consider whether

there will be adequate finance available to complete the project.

3 Development expenditure recognised as an asset must be amortised over a period not exceeding five years.

According to IAS 38 Intangible assets, which of the following statements about research and development expenditure are

correct?

1 If certain conditions are met, an entity may decide to capitalise development expenditure.

2 Research expenditure, other than capital expenditure on research facilities, must be written off as incurred.

3 Capitalised development expenditure must be amortised over a period not exceeding 5 years.

4 Capitalised development expenditure must be disclosed in the statement of financial position under intangible non-current

assets.

According to IAS 38 Intangible assets, which of the following statements concerning the accountingtreatment of research and development expenditure are true?

1 Development costs recognised as an asset must be amortised over a period not exceeding five years.

2 Research expenditure, other than capital expenditure on research facilities, should be recognised as an expense as

incurred.

3 In deciding whether development expenditure qualifies to be recognised as an asset, it is necessary to consider whether

there will be adequate finance available to complete the project.

4 Development projects must be reviewed at each reporting date, and expenditure on any project no longer qualifying for

capitalisation must be amortised through the statement of profit or loss and other comprehensive income over a period no exceeding five years.

According to IAS 38 Intangible assets, which of the following are intangible non-current assets in the financial statements of

Iota Co?

1 A patent for a new glue purchased for $20,000 by Iota Co

2 Development costs capitalised in accordance with IAS 383 A licence to broadcast a television series, purchased by Iota Co

for $150,0004 A state of the art factory purchased by Iota Co for $1.5million

Which of the following items could appear on the credit side of a receivables ledger control account?

1 Cash received from customers

2 Irrecoverable debts written off

3 Increase in allowance for receivables

4 Discounts allowed5 Sales6 Credits for goods returned by customers7 Cash refunds to customers

An inexperienced bookkeeper has drawn up the following receivables ledger control account:

RECEIVABLES LEDGER CONTROL ACCOUNT

$ $

Opening balance 180,000 Credit sales 190,000

Cash from credit customers 228,000 Irrecoverable debts written off 1,500

Sales returns 8,000 Contras against payables 2,400

Cash refunds to credit customers 3,300 Closing balance (balancing figure) 229,60

0Discount allowed 4,200

423,500 423,500

What should the closing balance be after correcting the errors made in preparing the account?

The payables ledger control account below contains a number of errors:

PAYABLES LEDGER CONTROL ACCOUNT

$ $

Opening balance (amounts owed to suppliers) 318,600 Purchases 1,268,600

Cash paid to suppliers 1,364,300 Contras against debit 48,000

Purchases returns 41,200 balances in 8,200

Refunds received from suppliers 2,700 receivables ledger 402,000

$1,726,800 Discounts received $1,726,800

Closing balance

All items relate to credit purchases.

What should the closing balance be when all the errors are corrected?

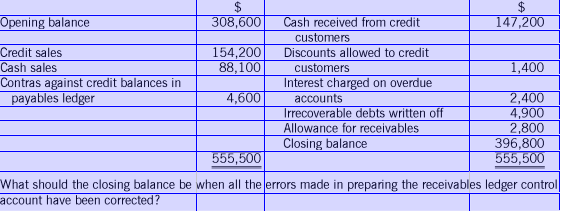

The following control account has been prepared by a trainee accountant:

RECEIVABLES LEDGER CONTROL ACCOUNT

The following receivables ledger control account prepared by a trainee accountant contains a number of errors:

RECEIVABLES LEDGER CONTROL ACCOUNT

$ $

20X4 20X4

1 Jan Balance 614,000 31 Dec Credit sales 301,000

31 Jan Cash from credit customers 311,000 Discounts allowed 3,400

Contras against amounts Irrecoverable debts

due to suppliers in written off 32,000

payables ledger 8,650 Interest charged on overdue

accounts 1,600

Balance 595,650 933,650

933,650

What should the closing balance on the control account be after the errors in it have been corrected?

Your organisation sold goods to PQ Co for $800 less trade discount of 20% and cash discount of 5% for payment within 14

days. The invoice was settled by cheque five days later Which one of the following gives the entries required to record

BOTH of these transactions?

DEBIT CREDIT

$ $