Ennerdale has been asked to quote a price for a one-off contract. The following information is available.

Materials

The contract requires 3,000 kg of material K, which is a material used regularly by the company in other production. The company has 2,000 kg of material K currently in stock which had been purchased last month for a total cost of $19,600. Since then the price per kilogram for material K has increased by 5%.

The contract also requires 200 kg of material L. There are 250 kg of material L in stock which are not required for normal production. This material originally cost a total of $3,125. If not used on this contract, the stock of material L would be sold for $11 per kg.

Labour

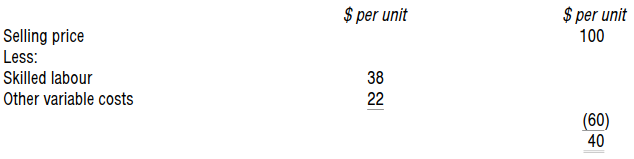

The contract requires 800 hours of skilled labour. Skilled labour is paid $9.50 per hour. There is a shortage of skilled labour and all the available skilled labour is fully employed in the company in the manufacture of product P. The following information relates to product P.

Required

Prepare, on a relevant cost basis, the lowest cost estimate that could be used as the basis for a quotation.

【论述题】

Prepare, on a relevant cost basis, the lowest cost estimate that could be used as the basis for a quotation.